10 Aug THE DANGERS OF IDLE CASH

Idle cash is money that is merely in a form that does not appreciate in value. Idle cash does not participate in economic markets and is therefore not creating any wealth.

Uninvested cash may feel more readily available compared to when it’s invested, however, there is always a better way to manage your funds. Keeping idle cash isn’t as useful as one might believe.

Therefore, uninvested funds gradually squander value over time, especially in an economic environment where they fail to keep up with the impacts of inflation.

Cash

The amount of cash to hold depends on each individual’s strategy and personal circumstances. While investing your cash can give you potentially better returns, always remember that cash is king! There are plenty of reasons to hold cash in places like your checking and savings account, such as to have easy access to those funds for day-to-day expenses.

Emergency Fund

It is vital to hold an amount as an emergency fund. As the name suggests, an emergency fund is for protecting yourself over financial matters for when unexpected circumstances arise. The amount to save for an emergency fund varies based on each individual’s personal circumstances. Most financial experts would highly encourage keeping three to six months of monthly income in an emergency fund. Some financial experts even advise an 8-month emergency fund because that’s how long it takes the average person to find a job.

Store your emergency fund in an account you can withdraw from any time you need to ensure high liquidity of funds. Whatever vehicle holding your cash should allow for easy access when you need it. A high-yield savings account is a good choice. Ultimately, maintaining and being able to access your emergency fund is paramount.

In addition, attempt to keep your emergency fund separate from your savings or checking account. This would help you to refrain from the temptation of tapping into your emergency savings for daily purchases. Another helpful tip would be to set up an automatic bank transfer to aid in a disciplined contribution towards an emergency fund.

Cons of Holding Idle Cash

Inflation

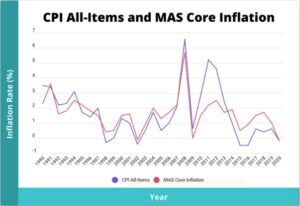

[Extracted from https://smartwealth.sg/average-inflation-rate-singapore/]

Holding cash has a significant chance of a real negative return over time due to inflation risk. This implies that your cash loses value over time. In Singapore, the average yearly inflation rate is approximately 2%. If your idle cash does not increase in value by a minimum of 2% in value, its purchasing power actually decreases as time passes.

To conclude, uninvested funds gradually lose value over time since they are incapable of keeping up with the effects of inflation. As a result, the $100 “under your mattress” will gradually only be able to buy $98 worth of items, then $96, then $94, and so on.

Losing Value

Cash is not a risk-free investment. Hence, it should not belong in any moderate to a long-term investment portfolio. It currently returns close to zero percent, and when you factor in inflation, it could lose you money. This implies that the more cash held in your portfolio, the more your portfolio could lose compared to a portfolio without cash.

Opportunity Cost

Holding too high of an allocation of cash restricts you from the possibility of earning higher returns through investments in other asset classes. Therefore, you fail to benefit from the money that can compound over time and garner even higher returns.

The Bottom Line

It is essential to hold a healthy amount of cash. Such cash should be liquid and accessible.

However, holding too much cash will result in an opportunity loss and loss of purchasing power due to inflation. The rest of your money needs to be working for you even harder. This is where you need to take advantage of compound interest and invest over a medium to the long-term investment horizon. Investing is how you take charge of your financial security. Investing is not only fundamental in preserving wealth, but it is imperative in growing wealth.

Deepak Singh is an Authorised Representative of Global Financial Consultants Pte Ltd – No: 200305462G | MAS License No: FA100035-3

To book a complimentary meeting, and explore how we can assist you, please use the following details.

✉ deepak.singh@gfcadvice.com

☜ https://calendly.com/deepakadvisory/introductory-meeting-our-office

General Information Only: The information on this site is of a general nature only. It does not take into account your individual financial situation, objectives, or needs. You should consider your own financial position and requirements before making a decision.

*Please note that Deepak Singh is not a tax agent or accountant and none of the content outlined here should be taken as personal advice. You should consult your tax agent and financial adviser to review your current personal finances and financial goals to consider whether this strategy is appropriate for you.

References

https://www.yourarticlelibrary.com/accounting/working-capital-management/cash-nature-and- motives-for-holding-it-working-capital/68146

https://corporatefinanceinstitute.com/resources/knowledge/finance/idle-cash/

https://www.yourquest.com/post/how-much-are-you-losing-to-idle-cash