26 Jul SHOULD YOU INVEST YOUR CPF?

To be eligible to invest under the CPF Investment Scheme (CPFIS), one needs to meet the following eligibility:

- At least 18 years of age,

- Not be an undischarged bankrupt and

- Have a minimum of $20,000 in your OA and $40,000 in your SA before you can start using funds from either account to invest

Whether one should invest their CPF has always been at the forefront of dilemmas of an individual’s financial planning. In this article, we attempt to discuss whether one should invest or not invest their CPF.

The funds held in our CPF earn us a risk-free interest rate as shown below.

| CPF Account | Current Interest Rate | When is it Reviewed? | Type | Determined by (whichever is higher) | Interest Rate |

| Ordinary Account | 2.50% | Quarterly | Floor | Legislated Minimum | 2.50% |

| Market | 3-month avg. banks’ interest rate | 0.57% | |||

| Special Account | 4.00% | Quarterly | Floor | Current interest rate floor | 4.00% |

| Market | 12-month avg. yield of 10SGS + 1% | 1.43% |

[Extracted from https://blog.seedly.sg/cpf-interest-rates/]

Therefore, as of 24th May 2021, the funds in our CPF earn us a risk-free rate of at least 2.50% (OA) or 4.0% (SA) per annum. Think of this as a hurdle rate since it is the minimum rate of return you should expect from your CPF investments. Should you choose to invest your CPF, you should aim for a net rate of return that exceeds the respective hurdle rates.

The Case for Not Investing Your CPF

Historical Performance

Based on the historical performance of CPFIS-OA members, here is a look at the percentage of CPF members who have profits of more than the benchmark 2.5% p.a.

| FY2019 | 46% |

| FY2018 | 38% |

| FY2017 | 74% |

| FY2016 | 78% |

| FY2015 | 27% |

[Extracted from https://blog.seedly.sg/cpf-investment-scheme-cpfis-oa-sa/ ]

As a result, while investing under the CPFIS may present you with the opportunity of growing your funds at a higher rate of returns, it is not guaranteed. If you’re not confident in doing so, it may be a better idea to allow your CPF to earn the risk-free interest rate.

Hidden Costs

You will be subject to additional costs and charges when investing your CPF monies. Such investment costs include transactional fees, brokerage fees, and sales charges amongst others. These investment costs eat into returns. Should you decide to invest your CPF monies via the CPFIS, you’ll want to have a clear understanding of these costs. Be sure to garner a precise understanding of these costs with your financial advisor.

However, in the past couple of years, there have been new rulings that have preferably led to lower investment costs for CPFIS investors in general. These will be discussed in detail further below.

The Case for Investing your CPF

Investment Time Horizon & Risk Profile

Investors with a longer time investment horizon can take on a higher level of risk in exchange for higher expected returns. With this in mind, it does make sense for those who wish to take on higher investment risk and have a long investment horizon (e.g. 20 years or more) to invest some of their CPF savings in the financial markets for higher returns. The earlier you start, the better your chance of achieving a better desirable outcome.

Opportunity Cost

If you would rather keep to the security of guaranteed returns, the interest rates offered by the CPF accounts are decent. However, there is a significant opportunity cost from failing to invest your CPF money. Holding too high of an allocation in your CPF restricts you from the possibility of earning higher returns through investments in other classes. This is especially true if you have a higher risk profile and a longer investment time horizon. Failure to invest your CPF monies could lead to a failure to benefit from the money that can compound over time and garner even higher returns.

No Taxation on Investment Returns

Any investment return from your CPF investments in the form of capital gains, dividends, and interests are not subject to tax. You will get the total returns from your investments completely.

Lower Investment Costs

The CPF Board announced a set of rulings that have led to lower investment costs. From 1st October 2020, fund sales charges will be slashed to 0%. In addition, portfolio wrap fees will be lowered up to 0.4%. These lower investment costs are beneficial to CPFIS in growing their monies.

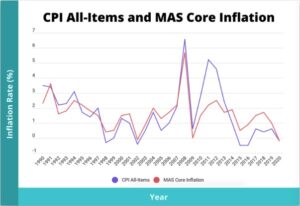

Outperform Inflation

[Extracted from https://smartwealth.sg/average-inflation-rate-singapore/]

Per Smartwealth, the average yearly inflation rate in Singapore is approximately 2%. Therefore, the interest rates guaranteed by the CPF accounts are not great at growing wealth, only preserving it. After taking into account inflation, if you aspire to grow your CPF monies at a higher growth rate, you will have a better chance of investing in your CPF.

Wide-Range of Asset Classes Available

The CPFIS allows CPF members to invest their CPF savings in a wide range of asset classes, such as:

- Bonds

- Fixed Deposits

- Insurance Products

- Shares

- Unit Trusts

- Exchange-Traded Funds (ETFs)

- Gold

This provides investors with the opportunity to diversify their investments across an extensive list of securities across a wide range of asset classes. For a full list of what you can invest your CPF monies in, refer to the extensive list provided on CPF’s website.

Things to Note

Transferring Money Into your Special Account

Transferring your CPF money from your OA to your SA to earn the higher interest rate of 1.5% is not the wisest. It comes with its significant complications as transferring your OA funds to SA is irreversible. This means that you will not be able to transfer the money back to your OA should you require the money to fund the purchase of your home or to spend it on education. Therefore, these funds will be locked up until you reach retirement.

Liquidity

When investing your CPF OA and SA monies, these investments can be easily sold off to channel the money back into the account. Investments under the CPFIS are known to be highly liquid.

Withdrawal of Dividends or Capital Gains Made on CPF Investments

Any returns in the form of dividends received or capital gains realized through CPFIS must be transferred back into our CPF accounts. Therefore, withdrawal of profits made from investments under your CPF accounts is prohibited. As a result, you should be investing with the future in mind. It is not worthwhile chasing risky investments for a quick gain since you’re not going to be able to enjoy the fruits of your investments for a long time.

Pecking order of CPF Investments

If you intend on investing your CPF monies, it makes sense to invest your OA savings first. This is because your OA savings earn an interest of 2.5% p.a. as compared to 4.0% for your SA.

The Bottom Line

Ultimately, whether to embark onto the CPFIS is very much dependent on each individual’s risk profile and the investment time horizon one has to work with. By embarking on the CPFIS you are giving up on the guaranteed interest rates offered by the relevant CPF account. Therefore, for this decision to make sense, your investments should be able to tide through market volatility and ultimately outperform the guaranteed interest rates offered by the respective CPF accounts.

Investing your CPF with GFC

We strongly believe that investing in your CPF is a key facet of growing your wealth and safeguarding your future retirement goals. It is never too late to grab hold of any opportunity that would allow you to grow your savings, and CPF provides that with their investments scheme (CPFIS).

The investment decisions made by the financial advisors at GFC have led to a consistent track record of outperforming the guaranteed interest rates offered by the relevant CPF account by a significant amount!

GFC’s knowledgeable consultants will help you come up with a comprehensive investment plan based on your financial circumstances, your retirement goals, and the products available through the scheme.

Deepak Singh is an Authorised Representative of Global Financial Consultants Pte Ltd – No: 200305462G | MAS License No: FA100035-3

To book a complimentary meeting, and explore how we can assist you, please use the following details.

☜ https://calendly.com/deepakadvisory/introductory-meeting-our-office

General Information Only: The information on this site is of a general nature only. It does not take into account your individual financial situation, objectives, or needs. You should consider your own financial position and requirements before making a decision.

*Please note that Deepak Singh is not a tax agent or accountant and none of the content outlined here should be taken as personal advice. You should consult your tax agent and financial adviser to review your current personal finances and financial goals to consider whether this strategy is appropriate for you.

References

Should You Invest Your CPF Monies? (And How Endowus Wants To Help You With It)

https://blog.seedly.sg/cpf-investment-scheme-cpfis-oa-sa/

https://www.asia.aonhumancapital.com/home/insights-at-work/invest-cpf-savings

https://endowus.com/insights/5-things-to-note-before-you-invest-cpf/

https://www.asiaone.com/money/why-investing-or-not-investing-your-cpf-important

https://blog.moneysmart.sg/invest/cpf-investment-scheme-cpfis/

CPF Investment: Everything You Need to Know about Investing Your CPF Money 2019