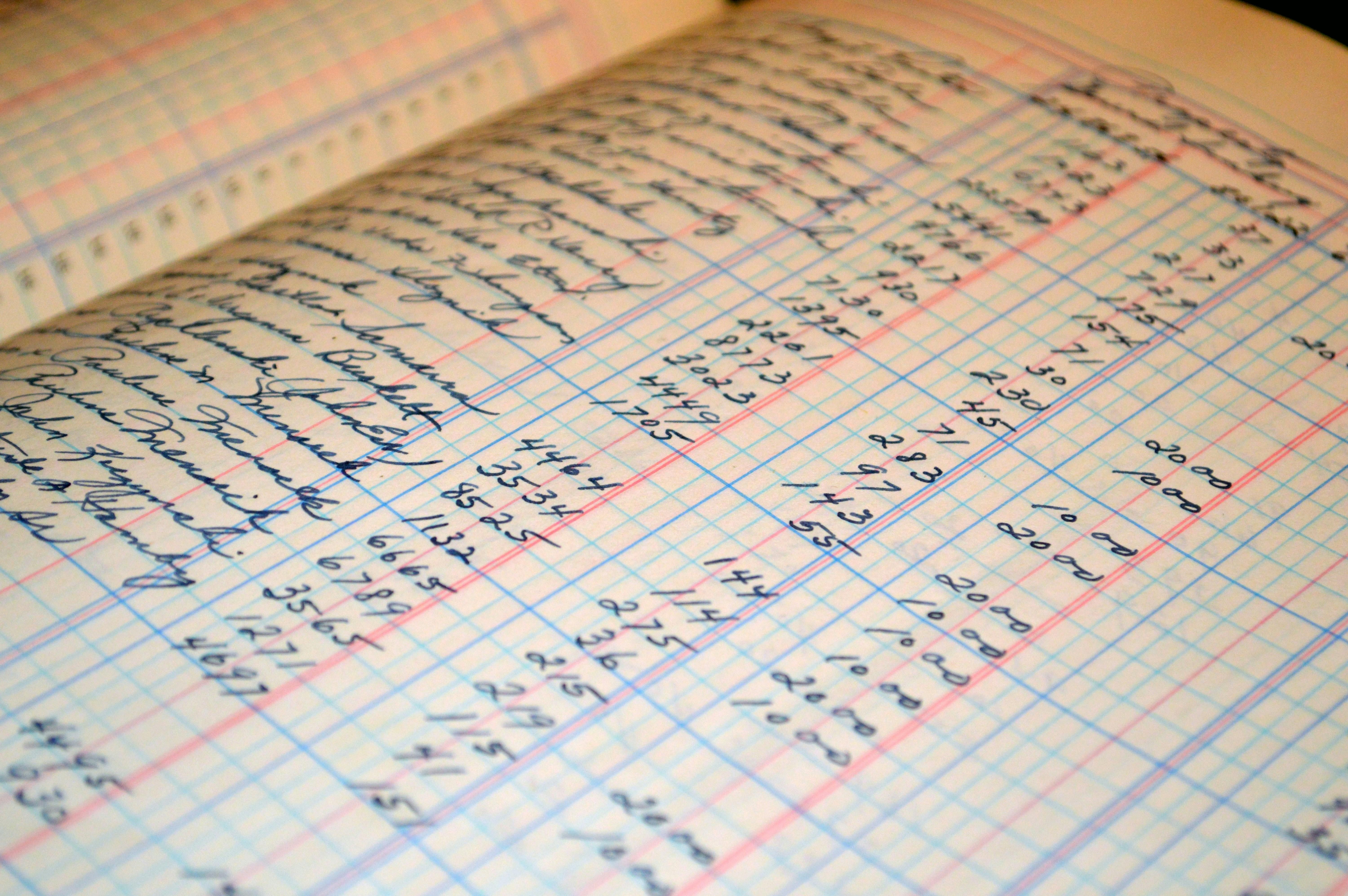

CPF Investment

Maximising Your CPF for Retirement

For Singaporeans and Permanent Residents, the Central Provident Fund (CPF) is a powerful tool for securing your financial future. This comprehensive social security system is designed to help you save for retirement, making it a key part of your financial planning journey.

Understanding the CPF System

All working Singaporeans and PRs, along with their employers, contribute to their CPF accounts monthly. The system is comprised of three main accounts: the Ordinary Account, the Special Account, and the Medisave Account. While its primary purpose is retirement savings, CPF can also be used for other essential needs, including healthcare, homeownership, family protection, and asset enhancement.

Unlocking Your CPF's Potential

While you can only fully access your CPF savings in your later years, we believe it would be a missed opportunity to simply leave the money there, even with the prevailing interest rates. We think your CPF could be working harder for you, helping you earn greater investment rewards and grow your nest egg more effectively.

Investing with the CPF Investment Scheme

To help you achieve your future retirement goals, it's crucial to seize every opportunity to grow your savings. The CPF Investment Scheme (CPFIS) provides just that. We know the terms and procedures can seem confusing and daunting, but that's what we're here for. We will guide you through the process, helping you navigate the scheme with confidence.

Frequently Asked Questions

Yes – CPF members can invest part of their balances in approved products.

Not always. It depends on your retirement needs, risk appetite and how you have structured your property.