Retirement Savings Structures to Choose From For The Aussie Expat

Tiffany Toh

I often get clients coming to me with the question, I have extra funds at the moment, should I contribute these funds to Superannuation?

Often, I would reply that if you are close to retirement or you have an investment with positive income in Australia then that maybe an option.

But there are other tax-effective savings structures apart from superannuation that maybe more effective for Australian working offshore.

When we think about planning for retirement we often think about Australian Superannuation. But as an Expatriate working overseas there is another choice.

There are two optimal structures for savings for Retirement. Usually, we use a structure to take advantage of better tax arrangements for the funds invested within them.

The two structures that we are going to talk about below are Superannuation and Insurance bonds.

Superannuation

Back in Australia, the structure we use to save for retirement is Superannuation. This was set up as a government employee retirement savings system in the 1980s. By 1992, the government of the day introduced the Superannuation Guarantee which mandated that all employers set aside 3% of their gross employee salaries to the Superannuation System in their employee’s individual accounts.

I am often asked whether one should contribute to superannuation whilst they are an expat living in Southeast Asia.

If you plan to retire in 3-5 years in Australia, there is the option to contribute to your Australian Superannuation account and top up the balances.

The other reason to consider contributing to your superannuation whilst you are overseas would be someone that has an investment in Australia earning positive income (for example property).

In this case, you could make concessional contributions from that income (property) to your superannuation account, therefore minimizing the amount of income you have left to pay the 32.5% rental income tax. You will still need to pay the contributions tax of 15% but this will save you 17.5% in tax would you have chosen to book the income and pay tax at the end of the financial year.

Insurance Bonds

If you are an expat living in a country with a low-income tax regime then there is a second structure that has the potential to offer a separate structure for the sole reason of planning for long-term or retirement. This structure has concessional tax arrangements for some types of insurance bonds.

These insurance bonds structures have been around for a long time and they can still be used to save money for children’s education. However, for expats, this is an opportunity to put money aside, and invest that money into the markets with the help of an adviser. When and if they move back to Australia and keep the insurance bond for 10 years the bond on maturity is tax-free.

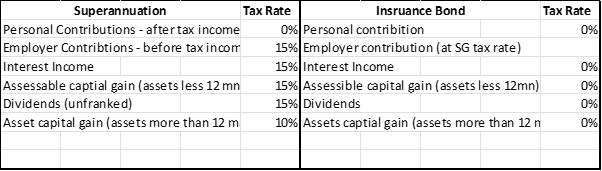

There are conditions to this arrangement as there are for superannuation. I like to remind clients when we continue putting money into our superannuation account from overseas, we pay a contribution tax of 15%. Selling shares or investments within the superannuation trust account, (for most superannuation we do not have control over what the superannuation trustee buys and sells with our funds), will attract capital gains tax of between 10 and 15%. Furthermore, when the investment pays a dividend, our super account pays a tax of 15% on that income.

With an insurance bond, as it is an investment that can be located in the Isle of Man, where investments there within the bond do not attract capital gains tax and are dividends tax-free.

Have a look at this chart for easy reference: Chart A

Any contributions you make to an insurance bond are tax-free.

Have a chat with your financial adviser or give me a call and I can answer any questions you may have about these insurance bonds.